Balanced mutual funds for stable growth are a compelling choice for investors looking to navigate the complexities of the financial market with ease. These funds combine both equity and fixed-income investments, striking a balance that aims to deliver steady returns while mitigating risks. By understanding the nuances of these funds, investors can make informed decisions that support their long-term financial goals.

In this discussion, we will explore the essential elements of balanced mutual funds, including their composition, advantages, and the strategies for integrating them into a broader investment portfolio. With a focus on stability and growth, balanced mutual funds stand out as an attractive option for those seeking to enhance their investment approach.

Understanding Balanced Mutual Funds

Balanced mutual funds are a unique investment vehicle designed to provide investors with the benefits of both equity and fixed-income investments. These funds aim to achieve a moderate level of risk while ensuring stable growth over time. By diversifying across different asset classes, balanced mutual funds allow investors to enjoy the potential for capital appreciation alongside regular income, making them particularly appealing for those seeking a balanced approach to investing.Typically, balanced mutual funds allocate their assets in a blend of stocks and bonds.

The stock component is responsible for driving growth through capital gains, while the bond portion helps cushion the portfolio against market volatility. This strategic allocation is often maintained in a fixed ratio, commonly around 60% equities and 40% fixed income, although this can vary based on the fund’s management strategy and market conditions. The dual nature of these funds works to stabilize returns, especially in fluctuating financial climates.

Types of Assets in Balanced Mutual Funds

The composition of balanced mutual funds is crucial in understanding how they achieve stable growth. The fund manager typically invests in a mix of the following asset types:

- Equities: The equity portion consists of shares in established companies, which can deliver significant returns during bull markets. This growth potential helps counterbalance the conservative nature of the bond investments.

- Bonds: Fixed-income securities such as government and corporate bonds provide steady interest income, which is essential for risk mitigation and helps stabilize overall portfolio performance.

- Cash or Cash Equivalents: Maintaining a portion in cash or cash equivalents allows the fund to meet redemption requests while providing liquidity. This flexibility can be advantageous during periods of market turbulence.

The allocation among these asset types is tailored to reflect market conditions; for example, during economic expansions, the equity component may be higher to capitalize on growth opportunities, whereas in downturns, the bond allocation may be increased to preserve capital.

Advantages of Investing in Balanced Mutual Funds

Investors considering balanced mutual funds benefit from several distinct advantages compared to other investment options. The following points highlight the key reasons these funds are a favorable choice:

- Diversification: Balanced mutual funds inherently provide diversification across various asset classes, which helps reduce risk and enhance potential returns compared to investing in a single asset type.

- Professional Management: These funds are managed by experienced professionals who continually analyze market trends and adjust the fund’s allocation accordingly, saving investors the time and effort of managing investments themselves.

- Reduced Volatility: By blending equities with fixed income, balanced mutual funds tend to experience less price fluctuation compared to pure equity funds, making them suitable for risk-averse investors.

- Accessibility: Investing in balanced mutual funds typically requires a lower initial investment compared to purchasing individual stocks or bonds, making them accessible for a wider range of investors.

In summary, balanced mutual funds present an effective solution for those seeking stability and growth in their investment portfolios, combining the strengths of both equity and fixed income in one comprehensive package. The strategic asset allocation, professional management, and inherent diversification make these funds a compelling option for various investor profiles.

Strategies for Investing in Balanced Mutual Funds

Investing in balanced mutual funds can be a strategic move for individuals aiming for stable growth in their portfolios. These funds typically invest in a mix of equities and fixed-income securities, offering a balance between risk and return. Understanding how to effectively select and invest in these funds can significantly influence your financial outcome.A systematic approach is essential when selecting balanced mutual funds for a stable growth portfolio.

This involves evaluating various performance metrics and understanding diversification’s role in enhancing investment stability. Below is a step-by-step guide to aid in selecting the best balanced mutual funds for your financial goals.

Step-by-Step Guide to Selecting Balanced Mutual Funds

Investors should follow a structured process to identify suitable balanced mutual funds. The steps listed below provide a clear pathway for making informed investment decisions.

- Define Investment Goals: Establish your financial objectives, including time horizon and risk tolerance.

- Research Fund Families: Investigate reputable fund families with strong management and a history of performance.

- Analyze Performance Metrics: Review historical returns, volatility, and risk-adjusted performance indicators like Sharpe Ratio.

- Examine Asset Allocation: Assess each fund’s asset allocation strategy to ensure it aligns with your risk appetite.

- Evaluate Expense Ratios: Compare the fees associated with different funds, aiming for low-cost options without compromising quality.

- Read Prospectuses: Thoroughly read the fund’s prospectus for insights into its investment strategy, objectives, and potential risks.

- Consider Tax Implications: Be mindful of how fund distributions may impact your tax situation.

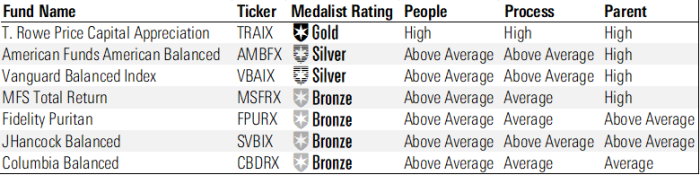

Comparison of Balanced Mutual Fund Options Based on Performance Metrics

When considering various balanced mutual funds, comparing their performance metrics can provide critical insights. The following table illustrates key metrics for several popular balanced mutual funds available in the market.

| Fund Name | 1-Year Return (%) | 3-Year Return (%) | 5-Year Return (%) | Expense Ratio (%) |

|---|---|---|---|---|

| Balanced Fund A | 8.5 | 9.2 | 10.1 | 0.75 |

| Balanced Fund B | 7.0 | 8.5 | 9.0 | 1.00 |

| Balanced Fund C | 9.0 | 10.0 | 11.5 | 0.60 |

This comparison allows investors to evaluate which fund may offer better returns and lower costs, facilitating a more informed decision-making process.

Importance of Diversification in Balanced Mutual Funds

Diversification plays a crucial role in balanced mutual funds, impacting investment stability positively. By spreading investments across various asset classes, balanced funds mitigate risks associated with market volatility.The following points emphasize the significance of diversification within balanced mutual funds:

-

Risk Reduction:

Diversifying investments minimizes the impact of any single asset’s poor performance on the overall fund.

-

Consistent Returns:

A well-diversified portfolio can provide more stable returns over time, which is essential for long-term growth.

-

Market Exposure:

Balanced funds typically allocate assets to both equities and fixed-income securities, providing exposure to different market conditions.

-

Inflation Hedge:

The combination of stocks and bonds can serve as a hedge against inflation, protecting purchasing power over time.

Understanding these aspects of diversification within balanced mutual funds is vital for maintaining a stable growth portfolio.

Integrating Balanced Mutual Funds into Broader Investment Plans

Balanced mutual funds serve as a versatile investment option, particularly attractive to long-term investors seeking a blend of growth and stability. By incorporating these funds into a broader investment strategy, individuals can enhance their retirement planning and achieve more comprehensive financial goals. Understanding how to position balanced mutual funds within an overall investment strategy is essential for effective portfolio management.

Balanced Mutual Funds in Retirement Planning

Incorporating balanced mutual funds into a retirement plan can provide a steady growth potential while mitigating risks associated with market volatility. These funds typically invest in both equities and fixed-income securities, offering a balanced approach that can be particularly beneficial as investors transition into retirement.

-

Stable Growth:

Balanced mutual funds can contribute to stable growth over time, helping to accumulate wealth in preparation for retirement.

-

Diversification:

By investing in a mix of asset types, these funds inherently provide diversification, which is crucial for managing risk as one approaches retirement.

-

Income Generation:

Many balanced funds include income-generating assets, which can provide retirees with a steady stream of income.

Complementing Balanced Mutual Funds with Other Investment Strategies

Balanced mutual funds can be effectively complemented with other investment strategies, such as day trading and stocks. This combination allows for greater flexibility and the potential for enhanced returns, depending on the investor’s risk tolerance and market conditions.

-

Day Trading:

For those looking to capitalize on short-term market movements, day trading can provide immediate returns that may not be available through the more stable balanced funds.

-

Equity Investments:

Direct investment in individual stocks can lead to higher returns, particularly during bullish market conditions, complementing the stability provided by balanced mutual funds.

-

Risk Management:

By diversifying between balanced funds and more aggressive investment strategies, investors can create a tailored approach that aligns with their financial objectives.

Monitoring and Adjusting Balanced Mutual Fund Investments

Regular monitoring and adjustment of balanced mutual fund investments are crucial aspects of effective portfolio management. This ensures that the investments remain aligned with the investor’s changing financial goals and market conditions.

-

Performance Review:

Investors should periodically review the performance of their balanced mutual funds against benchmarks and make necessary adjustments based on their investment objectives.

-

Rebalancing:

As market conditions change, rebalancing the portfolio by adjusting the proportions of balanced mutual funds and other investments can help maintain the desired risk-reward profile.

-

Market Trends:

Staying informed about market trends and economic indicators can guide decisions on when to increase or decrease allocations to balanced mutual funds.

Conclusive Thoughts

In conclusion, balanced mutual funds for stable growth offer a strategic pathway for investors aiming to achieve a balanced portfolio. By leveraging the diverse asset classes within these funds, investors can not only secure their capital but also position themselves for potential growth. Understanding how to effectively select and manage these investments is crucial for maximizing their benefits, making balanced mutual funds a worthwhile consideration for anyone committed to a sound investment strategy.

Clarifying Questions

What are balanced mutual funds?

Balanced mutual funds are investment vehicles that allocate funds across multiple asset classes, primarily stocks and bonds, to achieve growth while managing risk.

How do balanced mutual funds provide stable growth?

They combine equity for potential growth and fixed income for stability, thus offering a smoother return profile compared to pure equity funds.

What should I consider when selecting a balanced mutual fund?

Look for performance history, asset allocation strategy, fees, and the fund manager’s experience to ensure suitability for your investment goals.

Can balanced mutual funds be used for retirement planning?

Yes, they can be a core component of a retirement strategy by providing both growth potential and income generation.

How often should I review my balanced mutual fund investments?

It is generally advisable to review your investments at least annually or whenever your personal financial situation or market conditions change significantly.