Roth IRA vs Traditional IRA in retirement presents a pivotal choice for anyone planning their financial future. Each account type offers unique benefits and drawbacks that can significantly influence your retirement savings strategy. Understanding these differences is essential for making informed decisions that align with your long-term goals.

In this exploration, we’ll delve into the fundamental differences between these two retirement accounts, examining their tax implications, eligibility requirements, and how they can shape your investment strategies over time. Whether you’re just starting your career or approaching retirement, knowing how to leverage these accounts can help maximize your savings potential.

Roth IRA vs Traditional IRA

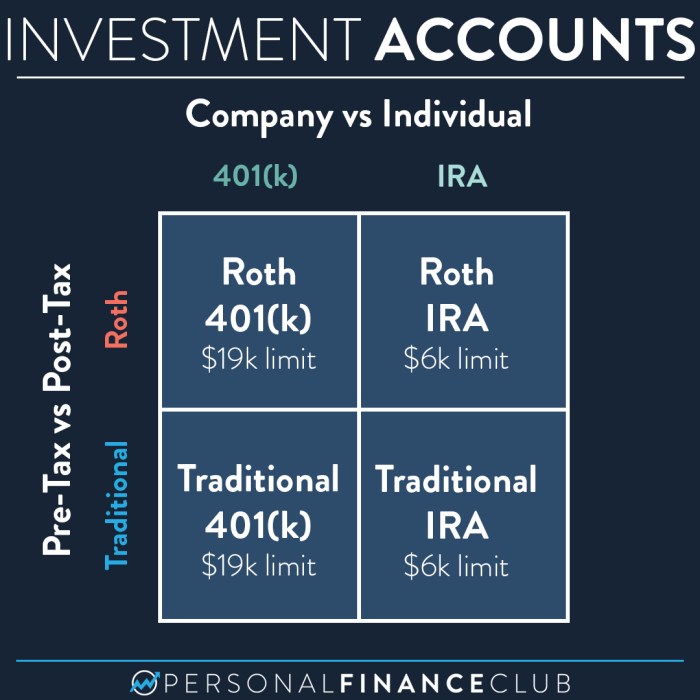

When planning for retirement, two popular options for individual retirement accounts (IRAs) are the Roth IRA and the Traditional IRA. Understanding the differences between these two accounts is crucial for making informed decisions about your retirement savings strategy. Each account comes with its own set of rules, tax implications, and eligibility requirements, which can significantly impact your financial future.The fundamental difference between a Roth IRA and a Traditional IRA lies in the timing of tax benefits.

Contributions to a Traditional IRA are made with pre-tax dollars, meaning you can deduct them from your taxable income in the year you make the contribution. Conversely, contributions to a Roth IRA are made with after-tax dollars, meaning you pay taxes upfront. However, the real advantage of a Roth IRA comes at withdrawal time: qualified distributions are tax-free. This contrasts with the Traditional IRA, where withdrawals are taxed as regular income in retirement.

Tax Implications of Contributions and Withdrawals

The tax implications of both Roth and Traditional IRAs play a significant role in retirement planning. Below is a breakdown of these implications.For Traditional IRAs:

- Contributions may be tax-deductible, lowering your taxable income for the year you contribute.

- Taxes are paid upon withdrawal during retirement, potentially leading to a higher tax bracket if income increases.

- Required Minimum Distributions (RMDs) must start at age 73, which can add to your taxable income.

For Roth IRAs:

- Contributions are made with after-tax dollars and are not tax-deductible.

- Qualified withdrawals during retirement are completely tax-free, assuming certain conditions are met.

- No RMDs are required during the account holder’s lifetime, allowing the account to grow tax-free for a longer period.

Eligibility Requirements for Both Accounts

Eligibility for each type of IRA varies based on income and tax filing status. Understanding these requirements is essential for effective retirement planning.For Traditional IRAs:

- Anyone with earned income can contribute, up to the annual limit.

- Deductibility of contributions may be limited based on participation in an employer-sponsored retirement plan and income level.

- For the tax year 2023, the contribution limit is $6,500, or $7,500 if you are age 50 or older.

For Roth IRAs:

- Eligibility to contribute phases out at higher income levels, depending on your tax filing status.

- For the tax year 2023, if you are single, your modified adjusted gross income (MAGI) must be less than $153,000 to contribute the full amount.

- Contributions can be made at any age as long as you have earned income, and there are no RMDs during your lifetime.

Benefits and Drawbacks

When considering retirement savings, both Roth IRA and Traditional IRA offer distinct advantages and disadvantages that can significantly impact long-term financial security. Understanding these can be crucial for making informed decisions about your retirement strategy.

Advantages of Using a Roth IRA

A Roth IRA provides several key benefits that make it an attractive option for long-term retirement savings. One of the most notable advantages is the tax-free growth potential. Contributions to a Roth IRA are made with after-tax dollars, meaning that any earnings generated within the account are tax-free when withdrawn in retirement, provided certain conditions are met. Additionally, Roth IRAs do not have required minimum distributions (RMDs) during the account holder’s lifetime, allowing funds to continue growing tax-free for as long as desired.

This can lead to greater accumulation of wealth over time. Furthermore, contributions can be withdrawn at any time without penalty, providing flexibility for emergency situations. To summarize the benefits:

- Tax-free withdrawals in retirement

- No RMDs during the account holder’s lifetime

- Flexibility to withdraw contributions anytime without penalty

Potential Disadvantages of a Traditional IRA

While Traditional IRAs are often viewed as a staple in retirement planning, they come with a few drawbacks. One significant disadvantage is the immediate tax deduction on contributions, which can lead to higher taxable income in retirement since withdrawals are taxed as ordinary income. This tax liability can potentially diminish the total amount of funds available during retirement.Moreover, Traditional IRAs impose RMDs starting at age 72, meaning account holders must begin withdrawing funds regardless of whether they need the money or not.

This can force individuals to take out more than they planned, subsequently increasing their tax burden. Key disadvantages include:

- Taxed withdrawals that can increase taxable income in retirement

- Mandatory RMDs starting at age 72

- Potential penalties for early withdrawals before age 59½

Long-Term Growth Potential Comparison

When comparing the long-term growth potential of Roth IRAs versus Traditional IRAs, the absence of taxes on qualified withdrawals in a Roth IRA can lead to superior growth over time. For instance, if an individual invests $5,000 annually in a Roth IRA from age 25 to 65, and achieves an average annual return of 7%, the account could grow to approximately $1.2 million by retirement.

In contrast, the same investment in a Traditional IRA would be subject to taxes upon withdrawal, potentially reducing the amount an individual can access.It’s essential to consider that the longer the investment horizon, the more pronounced the benefits of tax-free growth become, making Roth IRAs particularly advantageous for younger investors or those expecting to be in a higher tax bracket in retirement.

The following table illustrates the potential growth of both types of accounts over a 40-year period, assuming an annual contribution of $5,000 and a 7% annual return:

| Account Type | Final Amount at Age 65 |

|---|---|

| Roth IRA (Tax-Free) | $1,228,000 |

| Traditional IRA (Taxed upon withdrawal) | $1,228,000 (minus taxes) |

In summary, while both Roth and Traditional IRAs have their unique features, the choice ultimately depends on individual circumstances, tax considerations, and retirement goals. Understanding these dynamics can empower investors to make the best choices for their financial futures.

Investment Strategies for Retirement Accounts

Investing for retirement is a critical strategy that can significantly impact your financial security in later years. Whether utilizing a Roth IRA or a Traditional IRA, understanding the various investment options available is essential for maximizing growth and managing risks effectively. The right investment strategy will align with your risk tolerance, time horizon, and retirement goals.Investment choices within Roth and Traditional IRAs encompass a broad range of assets, each with unique characteristics that can affect overall performance.

Below is a comprehensive table illustrating various investment options available within these retirement accounts:

| Investment Option | Roth IRA | Traditional IRA |

|---|---|---|

| Stocks | Allowed; tax-free growth | Allowed; tax-deferred growth |

| Mutual Funds | Allowed; tax-free growth | Allowed; tax-deferred growth |

| ETFs (Exchange-Traded Funds) | Allowed; tax-free growth | Allowed; tax-deferred growth |

| Bonds | Allowed; tax-free growth | Allowed; tax-deferred growth |

| Real Estate Investment Trusts (REITs) | Allowed; tax-free growth | Allowed; tax-deferred growth |

| Commodities | Allowed with restrictions | Allowed with restrictions |

Day trading within Roth and Traditional IRAs presents unique challenges and considerations. Both account types allow for day trading; however, the frequency of trades can impact your overall strategy. Investors must be mindful of the “pattern day trader” rule, which requires a minimum balance of $25,000 in your account to execute more than three day trades within any rolling five-day period.

Investors should also recognize that while short-term capital gains from day trading are not taxed in a Roth IRA, they are subject to ordinary income tax in a Traditional IRA upon withdrawal. This distinction can influence how much risk an investor is willing to take with high-frequency trading.Market trends play a significant role in shaping investment choices for retirement planning.

Economic indicators, interest rates, and geopolitical events can influence market performance, which in turn can affect asset allocation and investment strategies. Investors should stay informed about current market conditions to adapt their strategies accordingly. For instance, during a market downturn, shifting to more conservative investments such as bonds or dividend-paying stocks might be prudent, whereas, in a bull market, equities and growth-oriented investments could present higher potential rewards.Utilizing tools such as market analysis reports and financial news can help keep investors aligned with trends and make informed decisions.

This proactive approach ensures that your retirement account is strategically positioned to capitalize on favorable market conditions while mitigating risks associated with adverse trends.

Closure

In conclusion, navigating the choice between a Roth IRA and a Traditional IRA is crucial for a successful retirement plan. Each account presents distinct advantages that cater to different financial situations and goals. Ultimately, understanding how these accounts work and their tax implications will enable you to make the best decision for your future financial security.

Key Questions Answered

What are the main tax differences between Roth and Traditional IRAs?

Roth IRAs use after-tax dollars for contributions, allowing tax-free withdrawals in retirement, while Traditional IRAs allow pre-tax contributions, which are taxed upon withdrawal.

Can I contribute to both a Roth IRA and a Traditional IRA?

Yes, you can contribute to both accounts as long as you stay within the annual contribution limits set by the IRS.

Are there income limits for contributing to a Roth IRA?

Yes, eligibility to contribute to a Roth IRA phases out at higher income levels, which can change annually based on IRS guidelines.

Is it possible to convert a Traditional IRA to a Roth IRA?

Yes, you can convert a Traditional IRA to a Roth IRA, but you will owe taxes on any pre-tax amounts converted.

Which IRA is better for younger investors?

A Roth IRA is often recommended for younger investors due to the potential for tax-free growth and withdrawals in retirement.