Tax-efficient retirement withdrawals are essential for ensuring your hard-earned savings last throughout your retirement. Navigating the complexities of different withdrawal strategies can feel overwhelming, but understanding how to optimize your retirement income can lead to significant savings. From taxable accounts to tax-deferred and tax-free options, making informed choices can enhance your financial security.

In this discussion, we will explore various methods for tax-efficient withdrawals, the impact of different investment types, and the importance of integrating tax efficiency into your retirement planning. By strategizing your withdrawals appropriately, you can minimize tax liabilities while meeting your income needs.

Tax-efficient Strategies for Retirement Withdrawals

When planning for retirement, one crucial aspect to consider is how to withdraw funds from your various accounts in a way that minimizes your tax burden. Tax-efficient withdrawals can significantly impact your overall retirement income and financial legacy. Understanding the tax implications of withdrawing funds from taxable, tax-deferred, and tax-free accounts can help you make informed decisions.Strategically managing your withdrawals involves considering the types of accounts you hold and the tax treatments associated with each.

Having a mix of taxable accounts (like brokerage accounts), tax-deferred accounts (like traditional IRAs), and tax-free accounts (like Roth IRAs) allows for greater flexibility and potential tax savings. It’s essential to adopt a methodical approach to withdrawals to optimize your taxable income and minimize tax liabilities during retirement.

Withdrawal Methods for Minimizing Tax Liabilities

Various withdrawal strategies can help you manage your tax exposure effectively. Here are some methods to consider:

- Sequential Withdrawal Strategy: This method advocates for withdrawing from your taxable accounts first, followed by tax-deferred accounts, and finally tax-free accounts. By doing this, you allow tax-deferred accounts to continue growing while leveraging the tax advantages of tax-free withdrawals later in retirement.

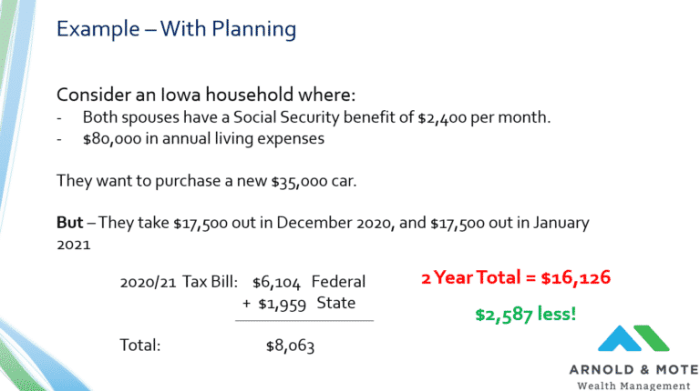

- Roth Conversion Ladder: Converting portions of your traditional IRA to a Roth IRA in low-income years can be beneficial. This strategy allows you to pay taxes on the converted amount at a lower rate, and future withdrawals from the Roth IRA will be tax-free, provided certain conditions are met.

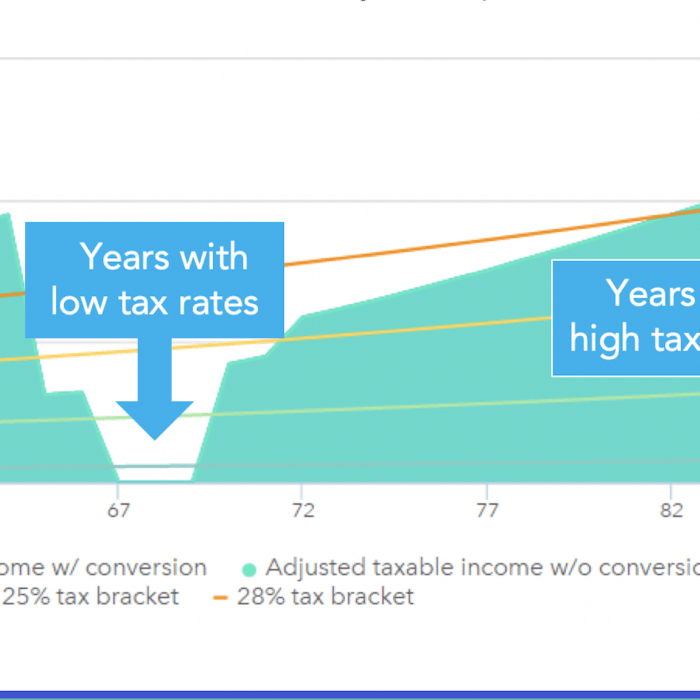

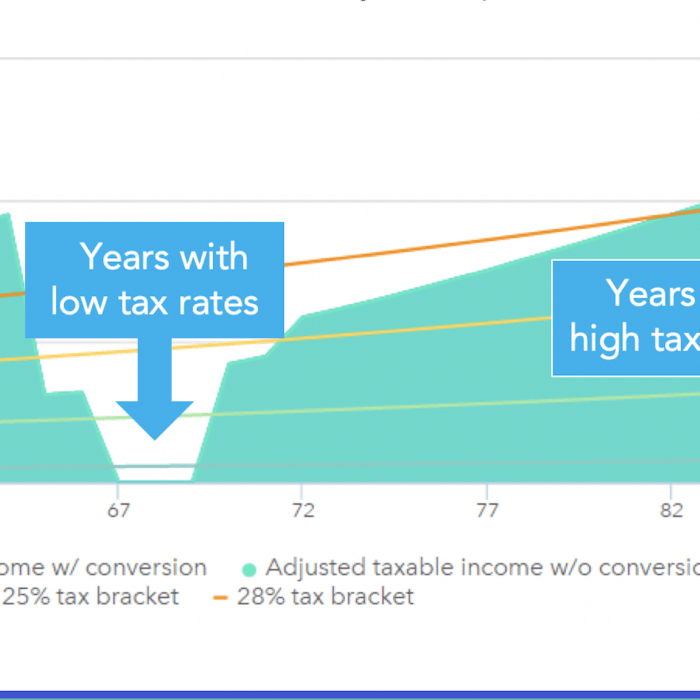

- Tax Bracket Management: Monitoring your taxable income to remain in a lower tax bracket can provide significant tax savings. Withdrawals should be planned to avoid pushing yourself into higher tax brackets. For example, if you are close to the upper limit of a 12% tax bracket, consider limiting withdrawals to stay within that bracket.

- Utilizing Capital Gains: For those with taxable accounts, it may be advantageous to withdraw funds from investments that have appreciated significantly, as long-term capital gains may be taxed at a lower rate than ordinary income.

Implementing a combination of these strategies based on your unique financial situation can lead to substantial tax savings. For instance, if you anticipate your income to be lower in certain years, leveraging that time to make Roth conversions can be particularly effective.

“Strategically withdrawing from various types of accounts can enhance your retirement income while minimizing tax liabilities.”

By utilizing a tailored approach to withdrawals, individuals can maximize their retirement savings and enjoy a more financially secure retirement.

Impact of Investment Types on Retirement Withdrawals

Understanding the various types of investments can significantly influence your retirement withdrawal strategy. Different investment vehicles come with unique characteristics that affect not only the growth of your portfolio but also the tax implications and withdrawal options available as you transition into retirement. With a solid grasp of these differences, retirees can make more informed decisions about how and when to withdraw funds from their accounts.The type of investment you hold can have a direct impact on your overall retirement strategy.

For example, stocks typically appreciate over time, while mutual funds offer diversification and ease of management. Commodities, on the other hand, can provide a hedge against inflation but may come with their own set of risks and tax considerations. Each of these investment types presents distinct scenarios when it comes to tax-efficient withdrawals.

Investment Types and Withdrawal Strategies

When planning retirement withdrawals, recognizing the implications of your investment types is crucial. Below are the primary categories of investments and their effects on withdrawal strategies:

- Stocks: Withdrawing from stock investments may trigger capital gains taxes, especially if the stocks have appreciated significantly. Long-term capital gains (for assets held over a year) are usually taxed at a lower rate compared to short-term gains. This emphasizes the importance of holding your investments long-term to minimize tax liability.

- Mutual Funds: Withdrawals from mutual funds can lead to tax implications based on the fund’s turnover rate and the underlying assets. Any withdrawals may be taxable as capital gains if the fund has distributed gains to investors throughout the year. Understanding the timing of withdrawals is essential to avoid unnecessary tax burdens.

- Commodities: Withdrawals from commodities can be treated as ordinary income, leading to a higher tax rate. Because commodities often involve active trading, keeping track of the cost basis and any associated gains or losses is vital for tax purposes.

The tax implications of withdrawing from different investment vehicles further complicate the retirement withdrawal landscape.

“The IRS treats different investment types in distinct ways, impacting your taxable income and overall financial strategy.”

Tax-efficient Strategies for Different Investment Approaches

When it comes to tax-efficient withdrawal strategies, the differences between day trading and long-term investment accounts are profound. Understanding these differences can help retirees optimize their income while minimizing tax liabilities.Long-term investments are generally favored for retirement accounts because they allow for compounded growth and lower capital gains taxes. In contrast, day trading generates short-term gains, which are taxed at higher ordinary income rates.

Here are some key points to consider:

- Long-term Investment Accounts: These accounts benefit from tax-deferred growth and lower long-term capital gains taxes. Retirees can withdraw funds strategically, optimizing for lower tax years and potentially utilizing tax brackets effectively.

- Day Trading Accounts: Withdrawals from day trading accounts may result in immediate tax liabilities due to frequent short-term capital gains. This can significantly reduce the effective returns on investments as taxes erode profits. Planning withdrawals to coincide with lower income periods can help mitigate these effects.

In summary, the type of investment you engage with plays a crucial role in shaping your retirement withdrawal strategy. Understanding the tax implications, along with the withdrawal strategies applicable to each investment type, can enable more efficient retirement planning and management, ultimately leading to a more secure financial future.

Retirement Planning and Tax Efficiency

Incorporating tax efficiency into retirement planning is crucial for maximizing your financial resources throughout your retirement years. As individuals transition from earning a salary to relying on savings and investments, understanding the tax implications of withdrawals becomes vital for sustaining a comfortable lifestyle. By strategically planning withdrawals, retirees can mitigate tax burdens and enhance their overall financial stability.Tax efficiency in retirement planning involves balancing income needs with the potential tax implications of different withdrawal strategies.

This requires a thoughtful approach to how and when assets are withdrawn. Retirees often have a mix of taxable and tax-deferred investments, and the order of withdrawals can significantly impact tax liabilities. Here’s a guide to help navigate these considerations effectively.

Strategies for Balancing Income Needs and Tax Implications

Navigating income needs while managing tax implications requires careful planning and an understanding of various financial strategies. Here are key considerations to effectively balance these elements:

- Prioritize Taxable Accounts: Withdraw from taxable accounts first, as these funds do not incur penalties for early withdrawal and allow tax-deferred accounts to continue growing. For instance, if you have a mix of a brokerage account and an IRA, tapping into the brokerage account can often be more tax-efficient.

- Use Tax-Deferred Accounts Wisely: Delay withdrawals from tax-deferred accounts like 401(k)s and IRAs as long as possible to allow for tax-free growth, while managing your required minimum distributions (RMDs) effectively once you reach age 72.

- Consider the Timing of Withdrawals: Be mindful of the tax brackets. Withdrawals made in years where your income is lower can minimize tax impact, allowing for strategic withdrawals at lower tax rates.

Incorporating these strategies can help retirees meet their income needs without incurring unnecessary tax burdens.

Analyzing and Adjusting Withdrawal Plans

Tax laws and personal circumstances can change, necessitating adjustments to withdrawal plans over time. Regularly analyzing your financial situation and tax obligations can lead to more effective withdrawal strategies. Here’s how to stay proactive:

- Review Tax Laws Annually: Stay informed about changes in tax legislation that could affect your retirement withdrawals. For example, changes to tax brackets or adjustments in RMD rules can impact your strategy significantly.

- Assess Personal Financial Shifts: Regularly evaluate your income needs, health expenses, and other financial obligations. If your needs increase or decrease, adjust your withdrawal strategy accordingly to maintain tax efficiency.

- Consult with Financial Advisors: Engaging with a tax professional or financial advisor can provide tailored insights into optimizing your withdrawal strategy, ensuring it aligns with both current tax laws and your personal financial goals.

By actively adjusting your withdrawal plans in response to legislative changes and personal circumstances, you can safeguard against unexpected tax liabilities and ensure a smoother transition into retirement.

Summary

In conclusion, mastering tax-efficient retirement withdrawals not only safeguards your savings but also empowers you to enjoy your retirement years with peace of mind. With thoughtful planning and a clear understanding of your options, you can strike a balance between required income and tax implications, allowing for a financially stable retirement. As tax laws evolve, revisiting your withdrawal strategy will ensure your approach remains aligned with your financial goals.

Frequently Asked Questions

What is a tax-efficient withdrawal strategy?

A tax-efficient withdrawal strategy involves planning the order and method of withdrawing funds from various accounts to minimize tax liabilities and maximize retirement income.

How can I determine the best accounts to withdraw from first?

Consider factors like your current tax bracket, the type of accounts you hold (taxable, tax-deferred, or tax-free), and your projected expenses to decide the optimal withdrawal sequence.

Is it better to withdraw from tax-deferred or tax-free accounts first?

Generally, it’s advisable to withdraw from tax-deferred accounts first to allow tax-free accounts to grow, but this may vary based on individual circumstances and tax implications.

How often should I review my withdrawal strategy?

You should review your withdrawal strategy annually or whenever there are significant changes in your financial situation or tax laws.

Can investment choices affect my tax-efficient withdrawals?

Yes, the type of investments can have different tax implications when withdrawn, so it’s important to consider these factors when developing your strategy.