Top indicators for day trading will guide you through the world of quick trades and rapid decisions, where every second counts. Dive into the nuances of technical analysis, volume metrics, and the powerful moving averages that can make or break your trading day.

By understanding these indicators, day traders can refine their strategies and enhance their decision-making process, leading to potentially profitable outcomes. Whether you’re a novice or seasoned trader, grasping these essential tools will help navigate the fast-paced trading environment.

Top Indicators for Day Trading

Day trading requires a keen understanding of market movements, which is where technical indicators come into play. These indicators are vital tools that help traders make informed decisions based on price patterns and trading volumes. Effective use of technical indicators can significantly enhance a trader’s ability to predict market behavior and take timely actions.Technical indicators are mathematical calculations based on the price, volume, or open interest of a security.

When used correctly, they can provide insights into market trends, potential reversals, and suitable entry or exit points. Among these indicators, some stand out for their effectiveness in the fast-paced world of day trading.

Effective Technical Indicators

Several technical indicators are widely used in day trading due to their reliability and ability to provide actionable insights. Below are the top indicators that traders often rely on:

- Moving Averages: This is a trend-following indicator that smooths out price data by creating a constantly updated average price. It helps traders identify the direction of the trend. The two most common types are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA), with the EMA giving more weight to recent prices, making it more responsive to new information.

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements on a scale of 0 to 100. An RSI above 70 typically indicates an overbought condition, while below 30 indicates an oversold condition, helping traders identify potential reversal points.

- MACD (Moving Average Convergence Divergence): This indicator shows the relationship between two moving averages of a security’s price. It consists of the MACD line, the signal line, and the histogram, which helps in identifying momentum and potential buy/sell signals.

- Bollinger Bands: These consist of a middle band (SMA) and two outer bands that are standard deviations away from the SMA. They help determine overbought or oversold conditions, with prices tending to move back towards the middle band after hitting the upper or lower bands.

Impact of Volume Analysis

Volume analysis is crucial in trading as it provides insight into the strength or weakness of a price movement. High volume during a price increase suggests strong buying interest, while high volume during a price decrease indicates strong selling interest. Traders analyze volume to validate trends and potential reversals. For example, if a stock price rises significantly but the volume remains low, it may signify a lack of conviction in the move, suggesting a potential reversal.

Conversely, high volume accompanying a price increase can confirm a strong bullish trend.

“Volume precedes price; a price move without volume is usually a false move.”

Using Moving Averages in Day Trading Strategies

Moving averages are integral to day trading strategies, providing valuable signals for entry and exit points. One common strategy is to use crossovers between short-term and long-term moving averages. For instance, when a short-term EMA crosses above a long-term EMA, it generates a bullish signal, indicating a potential buying opportunity. Conversely, when the short-term EMA crosses below the long-term EMA, it can indicate a bearish trend, signaling traders to consider selling or shorting the asset.

This technique is often enhanced by confirming signals from other indicators like the RSI or MACD, leading to more robust trading decisions. Another effective moving average strategy is the use of the “moving average envelope,” where bands are plotted above and below a moving average. This method helps identify overbought and oversold conditions, allowing traders to set target exit points when prices approach these boundaries.

Investing Strategies for Day Trading

Day trading requires a unique set of strategies and techniques to navigate the volatile nature of the markets. A successful day trader must combine technical analysis, market evaluations, and risk management to maximize profits and minimize losses. Understanding how to effectively utilize indicators and strategies is fundamental to becoming proficient in day trading.

Importance of Risk Management Techniques for Day Traders

Risk management is a critical component of any successful day trading strategy. It helps protect capital from the unpredictable nature of the stock market and allows traders to operate with a clear plan. Effective risk management techniques include the following:

- Setting Stop-Loss Orders: A stop-loss order automatically sells a stock when it reaches a certain price, limiting potential losses. This is vital in maintaining a disciplined approach to trading.

- Position Sizing: This involves determining the amount of capital to risk on a single trade based on the trader’s total capital and risk tolerance. A common rule is to risk no more than 1-2% of total capital on any single trade.

- Risk-to-Reward Ratio: Aiming for a favorable risk-to-reward ratio, such as 1:3, ensures that potential profits outweigh potential losses. This ratio helps in making informed decisions about entering and exiting trades.

Detailed Plan for a Day Trading Strategy Using Multiple Indicators

A robust day trading strategy often employs multiple indicators to assess market conditions and make informed decisions. Below is a detailed plan that incorporates various indicators:

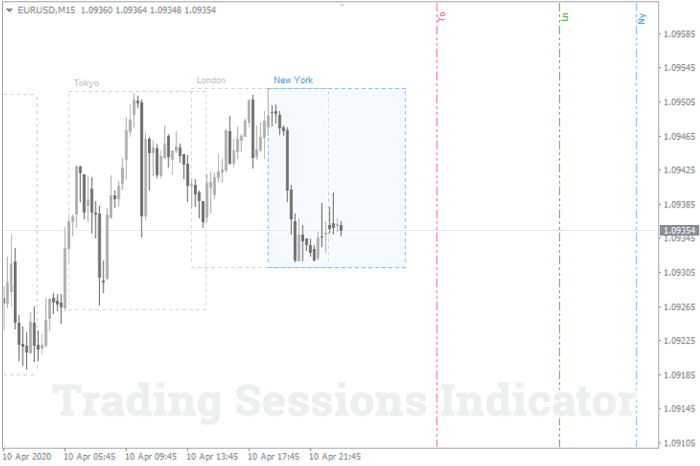

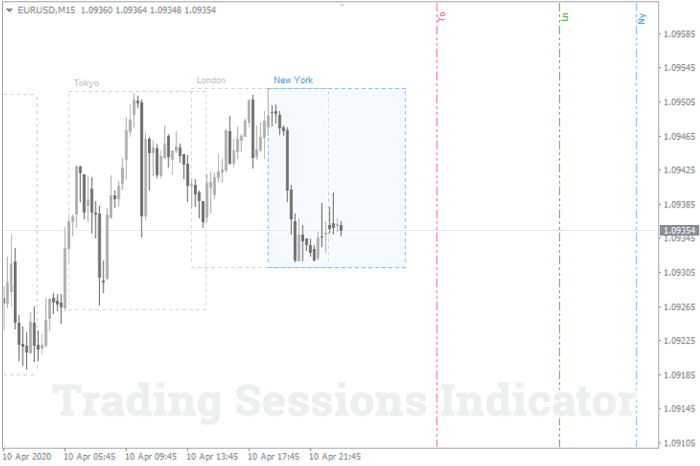

1. Identify the Trading Timeframe

Choose a specific timeframe for trading, such as 5-minute or 15-minute charts, to analyze price movements effectively.

2. Select Technical Indicators

Moving Averages (MA)

Use a combination of short-term (e.g., 5-period) and long-term (e.g., 20-period) moving averages to identify trends.

Relative Strength Index (RSI)

This momentum oscillator helps determine overbought or oversold conditions, typically using the 14-period setting.

Bollinger Bands

These bands provide insights into price volatility and potential breakout points.

3. Entry and Exit Signals

Look for crossover signals from moving averages to enter trades.

Utilize the RSI for overbought and oversold signals to confirm entry points.

Set exit points based on predefined profit targets or trailing stop losses.

4. Review and Adjust

After each trading session, analyze outcomes to refine the strategy, making necessary adjustments based on performance and market conditions.

Methods for Evaluating Market Conditions Before Making Trades

Before executing any trades, assessing market conditions is paramount to successful day trading. The following methods can aid in evaluating market dynamics effectively:

Economic Calendars

Monitoring economic news releases can provide insight into market sentiment. Key indicators such as employment rates, GDP, and inflation figures can dramatically affect market movements.

Market Sentiment Analysis

Tools such as the Fear and Greed Index can help gauge overall market sentiment, indicating potential bullish or bearish phases.

Technical Chart Analysis

Analyzing price patterns, support and resistance levels, and volume trends can reveal the current state of the market and identify potential trading opportunities.

Pre-Market and After-Hours Trading

Observing price movements and volume in pre-market and after-hours trading can help assess market strength before the official market opens.By employing these strategies and techniques, day traders can increase their chances of success while navigating the fast-paced world of trading.

Related Topics in Investing

Understanding the distinctions between various investment strategies is crucial for anyone looking to navigate the financial landscape effectively. While day trading focuses on short-term market movements, other approaches, such as mutual fund investing and futures trading, offer different risk profiles and strategies. This section delves into key comparisons and integrations that help clarify these investment methodologies.

Differences Between Day Trading and Investing in Mutual Funds

Day trading and mutual fund investing represent two fundamentally different approaches to capitalizing on market opportunities. Day trading is characterized by rapid buying and selling of securities, often within the same day, seeking to profit from short-term price movements. In contrast, mutual fund investing typically involves purchasing shares in a professionally managed fund that pools money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities.

- Time Horizon: Day trading operates on a short-term basis, with trades lasting from seconds to hours. Mutual funds, however, are designed for long-term growth, often held for years.

- Risk and Volatility: Day traders face high volatility and risk due to the nature of their trades, while mutual funds generally provide a more stable investment due to diversification.

- Management Style: Day trading is actively managed by individuals or teams, while mutual funds are managed by professional fund managers who make decisions based on market research and analysis.

- Fees: Day trading incurs transaction fees for each trade, which can add up quickly, whereas mutual funds typically charge management fees and possibly sales loads.

- Liquidity: Day traders enjoy immediate liquidity but risk being unable to execute trades at desired prices. Mutual fund investors may face redemption delays but benefit from a more predictable pricing structure.

Integration of Futures and Commodities into a Day Trading Portfolio

Incorporating futures and commodities into a day trading portfolio can provide opportunities for diversification and potential profit. Futures contracts allow traders to speculate on the future price movements of commodities like oil, gold, and agricultural products without owning the underlying asset.

- Leverage: Futures trading typically involves using margin, allowing day traders to control larger positions with a smaller initial investment, which can amplify both gains and losses.

- Market Reactions: Commodities often react to global economic factors, weather patterns, and geopolitical events, providing traders with opportunities to capitalize on volatility.

- Diversification: Adding commodities to a day trading strategy can enhance portfolio diversification, reducing reliance solely on equities or other asset classes.

- Hedging Opportunities: Day traders can use futures as a hedging tool to protect positions in equities or other securities against adverse price movements.

- Technical Analysis: Many traders use technical indicators to analyze commodity price movements, which can complement their day trading strategies and improve decision-making.

Comparison of Retirement Planning Strategies with Active Day Trading Approaches

Retirement planning and active day trading cater to different financial goals and risk appetites. While day trading seeks quick returns through frequent trading, retirement planning emphasizes building a stable, long-term investment strategy that secures financial independence.

- Investment Goals: Day trading focuses on generating immediate profits, while retirement planning is oriented towards long-term wealth accumulation and income stability.

- Risk Tolerance: Day traders often embrace high-risk strategies, whereas retirement planning typically involves a more conservative approach to mitigate risks over time.

- Asset Allocation: Day trading may involve a concentrated portfolio with high turnover, while retirement portfolios generally favor diversified, low-turnover investments.

- Time Commitment: Active day trading requires significant daily time commitment to monitor markets, while retirement planning can be managed with periodic reviews and adjustments.

- Tax Implications: Short-term capital gains from day trading are taxed at a higher rate compared to long-term capital gains from investments held for retirement, impacting overall returns.

Last Word

In conclusion, mastering the top indicators for day trading equips you with the knowledge needed to assess market conditions effectively and execute timely trades. With a solid grasp of risk management and strategy formulation, you can elevate your trading game and potentially achieve greater success in the bustling world of day trading.

Commonly Asked Questions

What are the most popular indicators for day trading?

The most popular indicators include moving averages, Relative Strength Index (RSI), Bollinger Bands, and MACD.

How can volume analysis impact trading decisions?

Volume analysis helps traders confirm trends; high volume can signal strong momentum, while low volume may indicate potential reversals.

Do I need to use multiple indicators for day trading?

Using multiple indicators can provide a more comprehensive view of market conditions, enhancing the likelihood of successful trades.

What is the role of risk management in day trading?

Risk management is crucial in day trading to protect capital and minimize losses, helping maintain a sustainable trading approach.

Can day trading strategies be applied to other markets?

Yes, day trading strategies can be adapted to various markets, including stocks, forex, futures, and commodities.